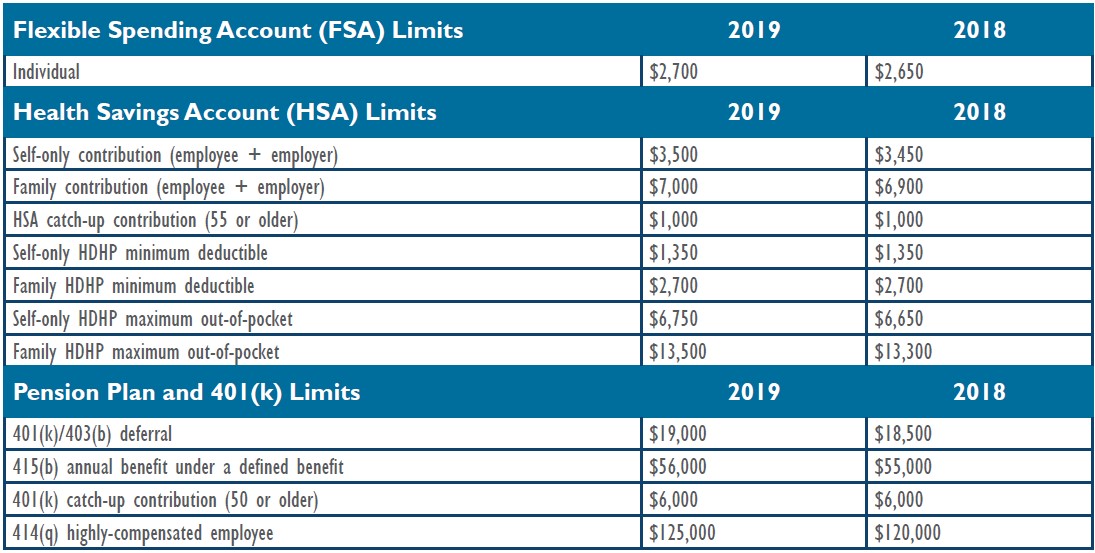

Max Contribution To Fsa 2025 - Significant HSA Contribution Limit Increase for 2025, Here, a primer on how fsas work. For 2023, the employee salary reduction contribution dollar limitation was $3,050. For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

Significant HSA Contribution Limit Increase for 2025, Here, a primer on how fsas work. For 2023, the employee salary reduction contribution dollar limitation was $3,050.

Fsa Maximum For 2025 Eryn Odilia, Here, a primer on how fsas work. The fsa contribution limits increased from 2023 to 2025.

Fsa 2023 Contribution Limits 2023 Calendar, The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2023) employers may impose. For 2023, the employee salary reduction contribution dollar limitation was $3,050.

Maximum Defined Contribution 2025 Sandy Cornelia, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

What’s the Maximum 401k Contribution Limit in 2025? (2023), For 2025, the employee salary. In 2025, the fsa contribution limit increases from $3,050 to $3,200.

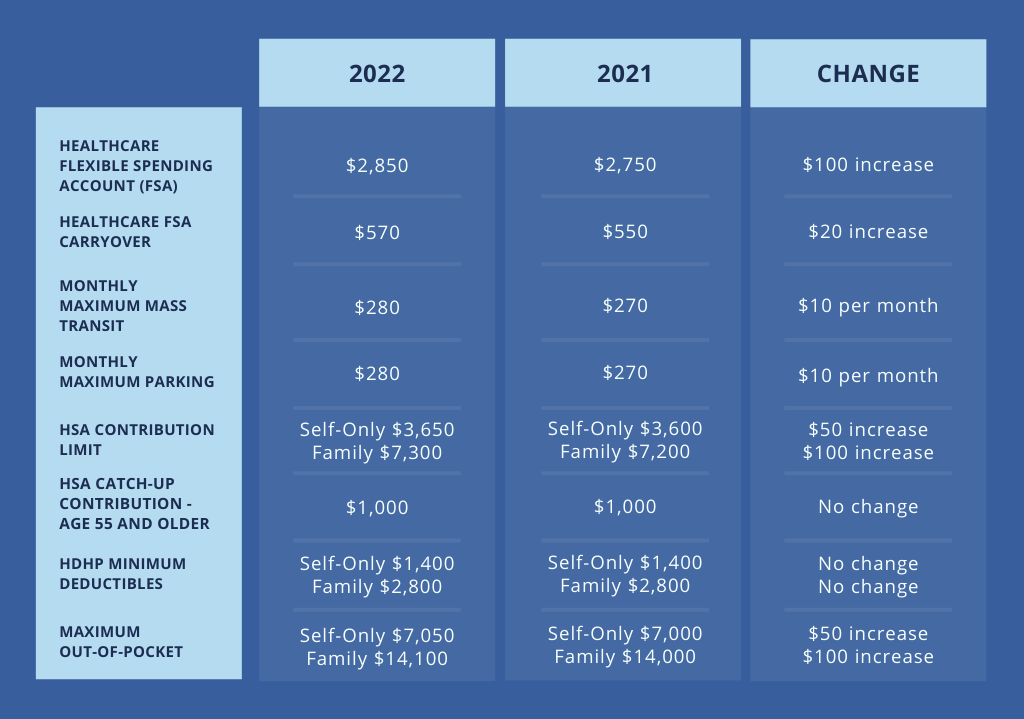

2025 Limits for FSA, HSA, and Commuter Benefits RMC Group, Keep reading for the updated limits in each category. For 2025, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2023.

You can contribute up to $8,300 to a family hsa for 2025, up from. The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts.

The fsa contribution limits increased from 2023 to 2025.

2023 Fsa Rates 2023 Calendar, Medical fsa limitation and maximum carryover amount for 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Like the 401(k) limit increase, this one is lower than the previous year’s increase.

Max Contribution To Fsa 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).